Our Guest Author Today: Mike Bailey

To an inexperienced seller, when you list your home might sound all the same. After all, you want to sell your home as soon as possible, so why should you be picky? However, just like the seasons, the housing market shifts. Many aspects can affect the state of the market. Consequently, you might find it harder to sell during a specific part of the year than during another. You may have doubts and questions about selling your home this winter. Therefore, let’s cover the pros and cons of property selling during the holiday season.

Should I sell right now or wait?

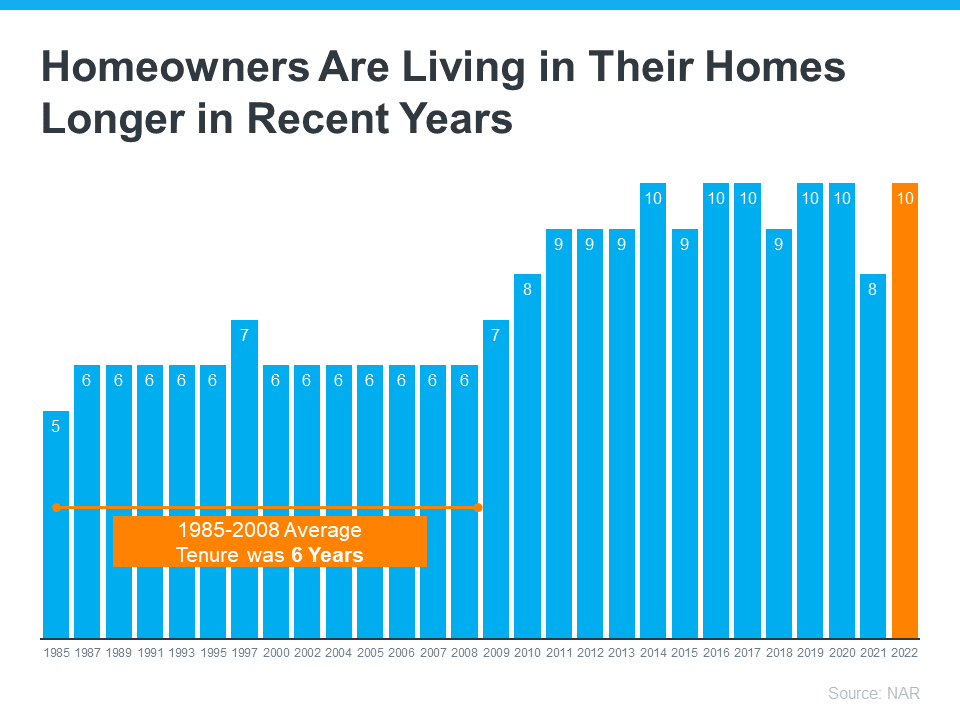

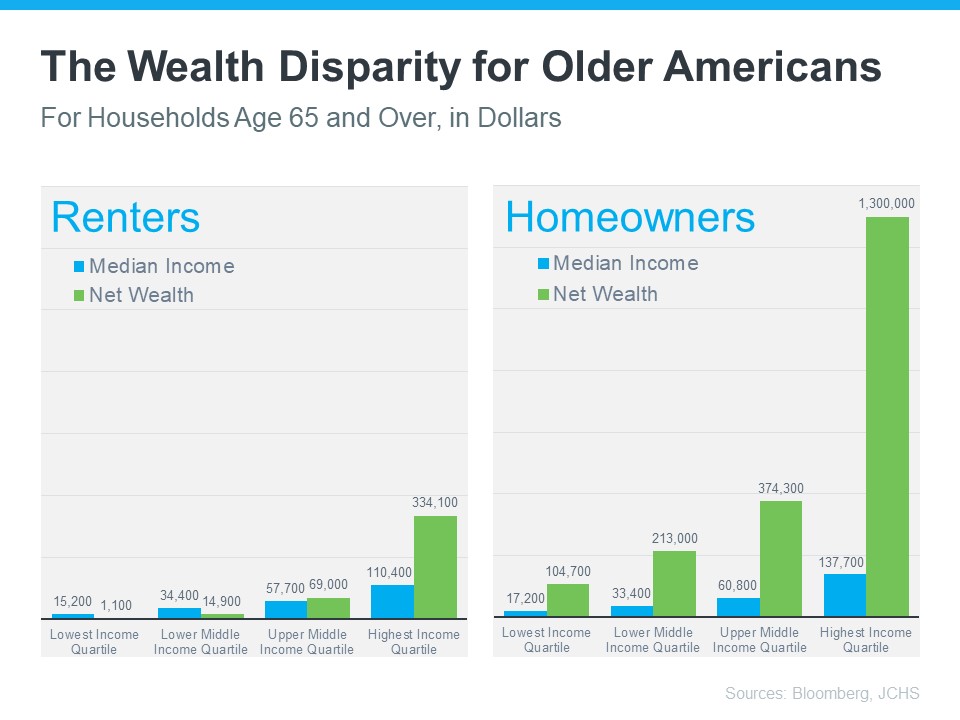

Overall, there was a steep rise in the housing market in 2022. That means that selling your home can be very profitable regardless of the season. Due to the effects of the pandemic, many investors have paused building new properties. The costs of building materials and buildable land have skyrocketed. This led to profits from selling barely outweighing the costs of building a new property. That led to the supply in terms of properties becoming more limited. On the other hand, the demand for residential properties remains high. That means now is a perfect time to sell your property at a great price, regardless of the season.

However, selling in winter is a bit of a different experience than selling during warmer seasons. Some aspects can affect your chances of selling your home quickly. On the other hand, there are also things to consider to increase your chances of selling. Let’s discuss this in a bit more detail.

Will I find fewer buyers in winter?

This may be one of the top questions about selling your home this winter. Traditionally, winter has always been the slowest season for selling residential property. The colder temperatures and snowy weather make it more difficult to travel. This, in turn, makes inspecting homes much more difficult for homebuyers. That is why many house hunters choose to do house tours in spring or summer. However, with the current state of the market, this is so much the case anymore.

With the real estate demands being so high, many buyers deliberately choose the winter period to house hunt. They do this to avoid the competition that comes in warmer seasons. Less competition means fewer bidding wars. In the end, this can help them buy the house they want for a much better price.

Another reason people choose to house hunt in winter is spare time. Winter is a holiday season, and many people take time off work. They use this time to tour listed homes while the competition is reduced. This also works favorably for you as a seller. You, too, will have more time to organize house showings for interested buyers.

However, one issue that comes with buying a house in winter is moving into it right after. The experts at Maximus Moving & Delivery say that moving in winter is riskier than doing so in warmer seasons. The ice and snow can make roads unsafe for vehicles. Many homebuyers are aware of this risk and would choose to wait out the winter. Depending on where you are, you might be having lots of snow or barely any. This can vastly affect the number of buyers you will see in winter.

Should I get a real estate agent?

A real estate agent serves to help reduce the workload that comes with listing a house. Their job is to find you serious buyers and have your home sold in the shortest amount of time. However, with the current state of the housing market, do you need one? If this is one of your questions about selling your home this winter, the short answer is “yes.”

Listing a house for sale is a lot of work, regardless of the season. If you have no experience with house selling, know it will take a lot of your time. You will have to organize house tours or open house days. You will need to always be available to answer questions from buyers. Additionally, many buyers contacting you won’t be seriously interested in the house. Weeding through the homebuyers to find serious can be very time-consuming. That is why having a real estate agent is so beneficial.

Real estate agents are well acquainted with the housing market’s current state. They can help you price your house correctly to earn maximum profit. In addition, they can handle all the customer interactions for you and weed out non-serious buyers. Real estate agents also conduct house tours in your stead. This is highly convenient if your house is far from where you currently live. You won’t have to drive to your home whenever you organize a tour.

There are also benefits to hiring a real estate agent in winter. Agents take on multiple clients at once, and more people are listing their properties for sale in warmer seasons. Your agent’s time will be more limited depending on the number of clients they work for. However, in winter, this is much less of an issue. Because fewer people are selling during the slow season, your agent’s schedule will be freer. They can dedicate more time and attention to you and your customers. This means that more house tours can be organized, increasing the chances of selling your home.

Final thoughts

As you can see, selling your house in winter can be a very smart move. Making use of the reduced competition can attract more customers to you. In addition, it is easier to find serious buyers during this period. Because winter is the season of holidays, many people are off work. That means that they will have more time to house hunt. Many homebuyers like to make use of this period in the hope of finding an affordable home. And, with reduced competition, the chances of entering a bidding war are much lower. These were some of the key questions about selling your home this winter.

Bio: Mike Bailey is a freelance content writer who specializes in writing articles regarding real estate. His favorite topic is writing articles with tips and tricks for inexperienced home sellers.

https://www.pexels.com/photo/snow-covered-house-and-trees-259583/

![2023 Housing Market Forecast [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2022/12/15124934/2023-Housing-Market-Forecast-KCM-Share-549x300.png)

![2023 Housing Market Forecast [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2022/12/15124929/2023-Housing-Market-Forecast-MEM.png)

![Reasons To Sell Your House This Season [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2022/12/08120834/Reasons-To-Sell-Your-House-This-Season-KCM-Share-549x300.png)

![Reasons To Sell Your House This Season [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2022/12/08120835/Reasons-To-Sell-Your-House-This-Season-MEM.png)

![Winter Home Selling Checklist [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2022/11/17130751/Winter-Checklist-KCM-Share-549x300.png)

![Winter Home Selling Checklist [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2022/11/17130752/Winter-Checklist-MEM.png)