THIS IS NOT AN ADVERTISEMENT

If you are just seeing this article and have not yet read Part One, please go back one week to the first of the series. I am sharing this with you all as a public service - no monetary or other consideration is exchanged between Tim and myself. Find out more about how we know each other in Part One today! Al Cannistra

Our Guest Author today: Tim Allen, BA, MM, CSA

“What Kind of Medicare Plan Might Fit Your Unique Needs?” (part two)

Client Tales – Part Two of a Three-Part Series

Welcome to Part 2 of Client Tales, where we’ve been sharing stories about Medicare beneficiaries, what plans worked best for each one and why. With Annual Enrollment right around the corner, the goal of this series is for you to be able to know which of the various options out there might best fit your unique needs and to help you avoid costly mistakes. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all your options.

My name is Tim Allen and we’ve been helping Medicare beneficiaries since 2005, TX License 1355125. I am the founder of

Your Retirement Inc and Sales Production Coach at

Affordable Health Insurance Agency where I’ve trained our agents for the past 14 years. I am a member of the Multi-Million Dollar Round Table and the National Association of Insurance and Financial Advisors. My bride has stuck with me for 45 years and we’ve been blessed with 2 wonderful children, 6 grandchildren, and one “in the oven.” Favorite pastimes include performing, composing & arranging music, kayaking, fishing, woodworking and being a Papa to his grandies.

So far in this series we have looked at the Medicare Advantage HMO and PPO plans through the eyes of my clients. In this session we will look at two popular Medigap supplement options with excellent value: G Plan and High Deductible G Plan. Would either of these plans work well for you and why? We’re going to share with you some rea-life Client Tales to help make that clear. I think you’ll see through these true stories that there is no “one size fits all!” BTW, the names and pictures have been changed to protect the identity of our clients.

Client Tale #4

William is our 4th Client. He had a heart transplant 2 years before turning 65 and was on his employer plan. At age 65 he had to leave that plan and went on Medicare. His anti-rejection medications for the new heart were very expensive and he still had many visits each year with specialists.

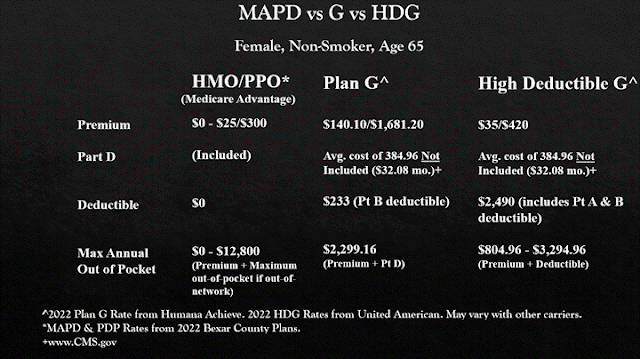

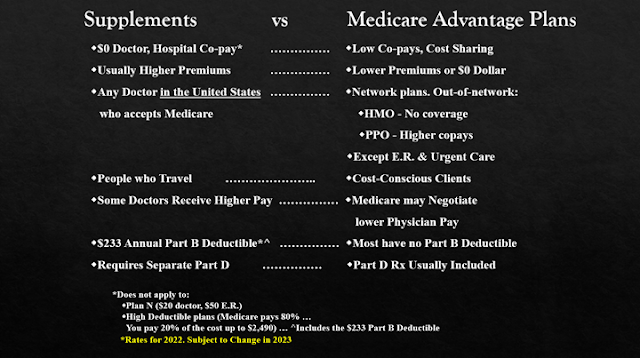

He did not like having to pay a higher premium for a Medicare supplement, but he chose that option with a Prescription Drug Plan to keep his costs for treatment as low as possible. This was the best fit for him. Many people think they can’t afford a Medicare Supplement. But even if William’s premiums were $2500 a year that would still be much less money than the approximate $3,400 - $12,500 maximum out‐of‐pocket cost of a Medicare Advantage plan when used a lot! As you can see, there is no “one size fits all!”

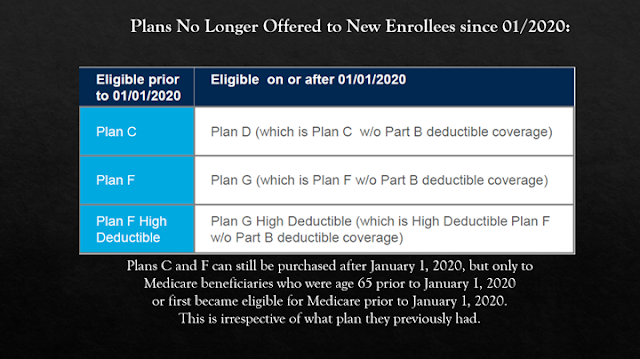

Medicare Supplements work with Medicare. Generally, Medicare pays 80% of the cost and your plan picks up the 20%. You may also be responsible for a $233 Part B deductible. But otherwise, you pay $0 for medical care. Supplements feature the Broadest Provider Choice. There are no Referrals Required and they are preferred by many Providers. What’s the downside? There is usually a higher monthly premium, and a separate stand-alone drug plan is required. There are often no (or less) Value Ads such as dental, vision or a health club membership. Health questions are not asked when you first turn 65, leave an employer, move out of state, or have another special election period. But otherwise, you may be denied coverage or charged more based on your health.

Client Tale #5

Our 5th Client Tale involves educators in the state of Texas that were on the Teachers’ Retirement System Health Plan (known as TRS), which is a very good fit for some people. But there may be other options out there for others through private health plans that could save them a lot of money and still provide excellent coverage.

My wife and I are a good example (pictured on the left). When my wife turned 65, she was in TRS. Jane was a retired teacher paying $135 per month in premium and my premium was more than $400. As a couple, we are saving more than $400 per month on a Medigap High Deductible G supplement with a Part D plan. There is no network, so we can go to any provider that accepts Medicare without a referral. If you are interested in this, there is a form that you will need to send to TRS and we’ll be happy to tell you more about it.

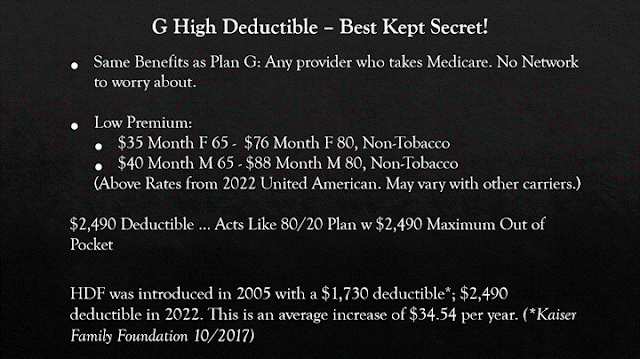

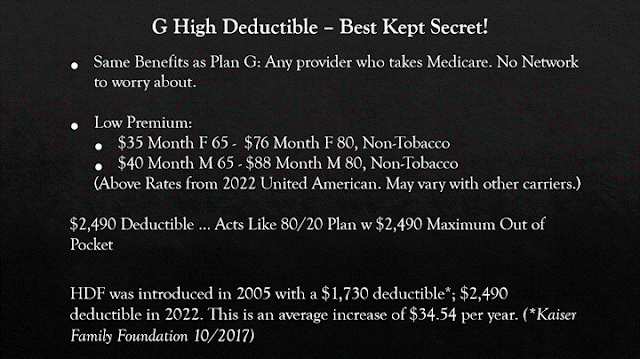

The G High Deductible Medigap Supplement plan may be one of the best‐kept secrets out there. Just like Plan G it is accepted by any provider who accepts Medicare. There is no Network to worry about.

It has a low premium:

• $35 Month for a female, 65-year-old non-smoker ‐ $76 Month at age 80

• $40 Month for a male, 65-year-old nonsmoker ‐ $88 Month at age 80.

It has a $2,490 Deductible which may function like an 80/20 Plan with a $2,490 Maximum Out-of-Pocket: Medicare will always pay the first 80%. Your 20% cost share accumulates toward the $2,490 deductible and when you reach that point you pay no more for the year and are covered at 100%. But your premiums are far less than plan G rates. This may not be the best alternative for everyone, but it provides an excellent value for many. It’s like having a Rolex watch on a Timex budget! See the illustration below regarding how it works:

Final Thoughts

We covered the Medicare Advantage HMO and PPO in podcast 1 and explored two of the Medigap Supplements in podcast 2. Do you know which plan will work well for you? It may not be possible to make that decision with the limited information that we’ve explored so far. So, tune in again for our third and final podcast next week where we will explore more options. We’ll also compare the plans sided by side. Finally, we will have a short pop quiz to confirm what you’ve learned. Again, there is “no one size fits all” – but which one is a perfect fit for you?

Click on this link or capture this QR code to watch a 25-minute video

that will explore these options in more detail:

This podcast is my original work and the pictures within are mine exclusively or I have purchased the right to use them.

By Tim Allen, BA, MM, CSA

We will publish Part Three one week from today. Make sure you come back for more great information.

Al Cannistra

Other pictures and/or charts created by Tim Allen..

![Fall Home Selling Checklist [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2022/09/20144848/20220923-KCM-Share-549x300.png)

![Fall Home Selling Checklist [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2022/09/20144842/20220923-MEM.png)

![Why It’s So Important To Hire a Pro [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2022/09/08160644/20220909-KCM-Share-549x300.png)

![Why It’s So Important To Hire a Pro [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2022/09/08160646/20220909-MEM.png)

![Here's Why It's Still a Sellers' Market [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2022/09/01081700/20220902-KCM-Share-549x300.png)

![Here's Why It's Still a Sellers' Market [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2022/09/01081654/20220902-MEM.png)